Management Report

Selected chapters from the Bertelsmann Management Report 2018 can be found here in digital form.

The complete Annual Report 2018 can be found here as a PDF flip catalog.

Financial Year 2018

Financial Year 2018 in Review

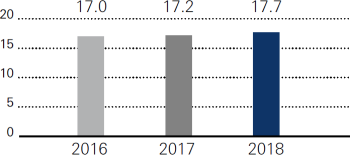

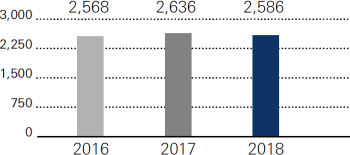

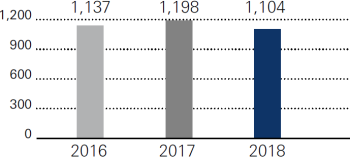

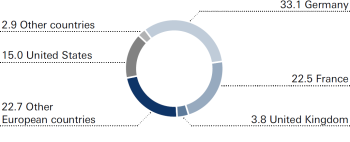

Bertelsmann can look back on a successful year in 2018. Group revenues rose by 2.8 percent to €17.7 billion (previous year: €17.2 billion). Organic growth increased to 2.7 percent (previous year: 1.7 percent) due to growth at RTL Group, Penguin Random House, BMG, Arvato and the Bertelsmann Education Group. The revenue share generated by the strategic growth businesses increased to 34 percent (previous year: 32 percent). At €2,586 million, operating EBITDA was once again at a high level. Operating EBITDA in the previous year was €2,636 million and included substantial capital gains from real estate transactions. Earnings growth at Penguin Random House, BMG, Arvato and the Bertelsmann Education Group was offset by declining earnings at Bertelsmann Printing Group in particular. The EBITDA margin went down from 15.3 percent in the previous year to 14.6 percent. Group profit was once again high, at €1,104 million, compared with €1,198 million in the same period in the previous year. For 2019, Bertelsmann again expects positive business performance.

- Revenue growth of 2.8 percent, organic growth of 2.7 percent

- Revenue increases at RTL Group, Penguin Random House, BMG, Arvato and Bertelsmann Education Group

- Organic revenue growth in growth businesses

- Decrease in operating EBITDA by 1.9 percent to €2,586 million

- Previous-year figure included capital gains from real estate transactions

- Decline in EBITDA margin to 14.6 percent compared with 15.3 percent in the same period in the previous year

- Group profit exceeds billion-euro mark for the fourth consecutive year

- Decline due to the lower operating result and greater impacts from special items

- Lower tax expense

Performance of the Group Divisions

RTL Group

In 2018, RTL Group once again achieved record-level revenues; operating EBITDA decreased against the backdrop of high gains from disposals of buildings in the previous year, but increased on a comparable basis. As part of its Total Video strategy, RTL Group expanded its video-on-demand (VOD) services, primarily in Germany, France and the Netherlands, and saw a significant increase in subscriber numbers. At the same time, the group invested more in in-house productions and high-quality content for international distribution. Online video views on RTL Group’s various digital platforms increased markedly in the year under review, to a total of 497 billion (previous year: 420 billion).

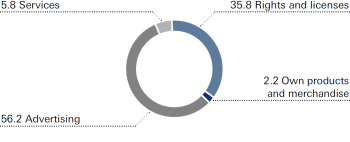

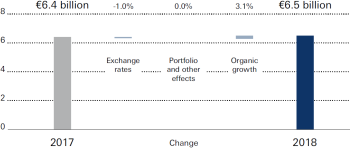

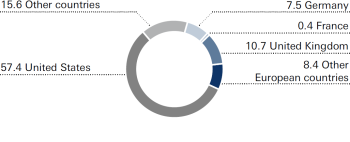

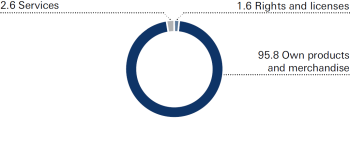

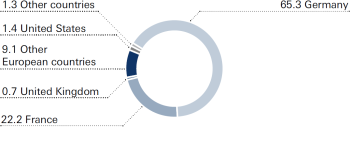

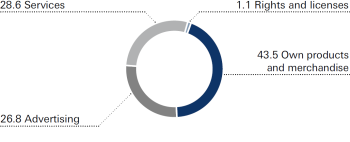

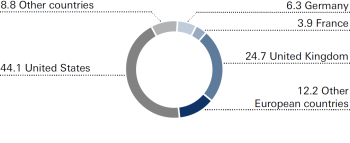

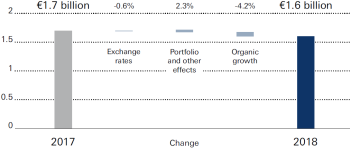

Despite negative exchange-rate effects, RTL Group’s revenues rose by 2.1 percent to a new record level of €6.5 billion (previous year: €6.4 billion). The rapidly growing digital business, the content production arm Fremantle and RTL Nederland were the primary growth contributors. Digital revenues, which mainly comprise revenues from multiplatform networks, VOD offerings and ad-tech businesses, increased to €985 million in the year under review (previous year: €826 million) and thus contributed 15.1 percent (previous year: 13.0 percent) to RTL Group’s total revenues. Operating EBITDA fell by 5.1 percent to €1.4 billion in 2018, after €1.5 billion in the previous year. Excluding the previous year’s capital gain on disposal, the increase was 1.3 percent. The EBITDA margin was 21.5 percent, following 23.2 percent in the previous year.

Mediengruppe RTL Deutschland’s revenues and earnings remained on a high level, although they slightly softened over the previous year. The declining German TV advertising market, but also major sports events such as the soccer World Cup and the Olympic Winter Games, all of which were broadcast on public television, contributed to this development. The family of channels’ combined average audience share in the main target group was 27.5 percent (previous year: 28.9 percent). At the end of 2018, Mediengruppe RTL relaunched its VOD service TV Now, which increasingly offers local, exclusive content and online-first formats. Mediengruppe RTL Deutschland teamed up with partners to launch the European NetID Foundation and with it a single log-in standard.

In France, Groupe M6’s revenues were down slightly on the previous year, while operating EBITDA increased. In particular, M6 Web and a capital gain from the transfer of Girondins de Bordeaux players contributed to the increase in earnings. The soccer club was sold at the end of the y ear. Groupe M6 achieved a combined TV audience share of 21.4 percent in the main target group (previous year: 22.3 percent). In the summer of 2018, Groupe M6, together with partners, announced a joint online video platform called Salto.

RTL Nederland recorded higher advertising revenues in 2018, as well as growth in its subscription VOD platform Videoland and other digital businesses. Revenues and earnings of RTL Nederland increased.

Fremantle reported substantial growth for 2018, driven by strong business performance in North America and Germany. The company was successful with numerous drama series such as “My Brilliant Friend” and “Deutschland 86,” which met with great interest from international audiences.

On January 1, 2018, Bert Habets took over as sole CEO of RTL Group.

Penguin Random House

Penguin Random House recorded organic revenue growth of 1.3 percent in the 2018 financial year. Negative exchange rates effects were more than offset by a strong bestseller performance, acquisitions and growth in digital audio downloads.

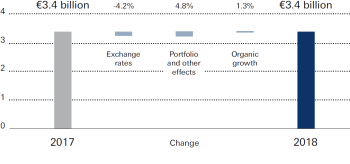

Including Verlagsgruppe Random House, the German publishing group wholly owned by Bertelsmann, the division increased its revenues by 1.9 percent to €3.4 billion in 2018 (previous year: €3.4 billion). The book group’s operating EBITDA increased by 1.3 percent to €528 million (previous year: €521 million). The EBITDA margin was once again high, at 15.4 percent (previous year: 15.5 percent).

The strongest growth drivers were audiobooks, which grew substantially in all the core markets, as well as the publication of former US First Lady Michelle Obama’s memoir “Becoming.” The book, which was launched simultaneously in 31 languages in mid-November 2018 under the direction of Crown Publishing, stormed the bestseller lists and sold more than seven million copies across all formats in the six weeks to the end of the year.

Penguin Random House announced the increase of its stake in the Brazilian publishing house Companhia das Letras to 70 percent. The publishing portfolio was also expanded with the acquisition of the nonfiction publisher Rodale Books in the United States and the Hindi-language paperback publisher Hind Pocket Books in India. In Singapore, the group established its new Penguin Random House South East Asia unit. Penguin Random House also invested in the expansion of direct relationships with readers and continued to optimize its retail supply chain.

In the United States, the book publishing group placed 481 titles on the “New York Times” bestseller lists last year, 69 at number one. Besides the top title, “Becoming” by Michelle Obama, major sellers included “The President Is Missing” by Bill Clinton and James Patterson, “12 Rules for Life” by Jordan B. Peterson and “The Reckoning” by John Grisham. More than 11 million copies of children’s book classics by Dr. Seuss were sold.

Penguin Random House UK recorded stable revenues in 2018, with growth in digital formats and license revenues. The group’s British imprints published 39 percent of the Top 10 titles on the “Sunday Times” weekly bestseller lists. The year’s bestsellers included “Becoming” by Michelle Obama and “12 Rules for Life” by Jordan B. Peterson, as well as “Jamie Cooks Italy” by Jamie Oliver and “Diary of a Wimpy Kid: The Meltdown” by Jeff Kinney.

Penguin Random House Grupo Editorial increased its revenues in 2018 and expanded its children’s book and audiobook offering for the Spanish-speaking world. Its bestselling titles were “La desaparición de Stephanie Mailer” by Joël Dicker, “Tú no matarás” by Julia Navarro and “Sabotaje” by Arturo Pérez Reverte.

In Germany, Verlagsgruppe Random House maintained its market-leading position, growing both its revenues and earnings. The publishing group had 386 titles on the “Spiegel” bestseller lists, including 20 at number one. Their top-selling title was Michelle Obama’s memoir, “Becoming.” In 2018, the publishing group purchased Der Audio Verlag, thereby expanding its audiobook publishing program.

Numerous Penguin Random authors won prestigious awards, including Michael Ondaatje, who received the Golden Man Booker Prize for “The English Patient” as the best work of fiction among the 50 Man Booker Prize winners through five decades.

Gruner + Jahr

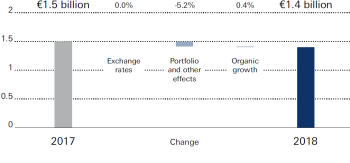

Gruner + Jahr continued its transformation. Revenues declined to €1.4 billion (previous year: €1.5 billion) due to portfolio adjustments; organically, revenues remained stable at the previous year’s level. The digital revenue share was further expanded in the core countries. At €140 million (previous year: €145 million), operating EBITDA was moderately below the previous year. The EBITDA margin improved to 9.7 percent (previous year: 9.6 percent).

G+J once again grew both its revenues and earnings in Germany. The decline in the print advertising business and newsstand sales, which was moderate compared to the rest of the market, was offset by strong digital growth, the expansion of the licensing business and new magazine businesses. Territory, the agency for content-driven communications, strongly increased its revenues and earnings.

The growing digital business also made a major contribution to the good business performance in Germany. In the German core market, the digital share of total revenues rose to around 29 percent. This increase was mainly driven by the strong performance of the AppLike marketing platform, which more than doubled its revenues. Other positive contributors were the expansion of the licensing business, including at “Schöner Wohnen,” and the growth of “Eat the World.” In addition, G+J launched several innovative new magazines in 2018. Along with the gourmet magazine “B-Eat,” G+J shaped and enriched the personality magazine genre with the addition of “Guido” and “Dr. v. Hirschhausen’s Stern Gesund Leben.” DDV Mediengruppe generated revenues on par with the previous year.

G+J France’s business recorded a sharp drop in overall revenues and earnings. Besides the sale of the title “VSD,” this was primarily due to the digital marketing platforms. The brand business, on the other hand, increased its earnings considerably despite declining print revenues. The digital offerings of the classic magazine brands – for example, “Voici,” “Gala” and “Télé Loisirs” – again recorded high growth in revenues and earnings.

BMG

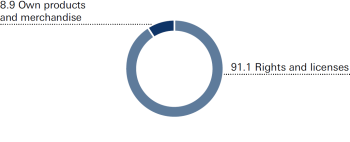

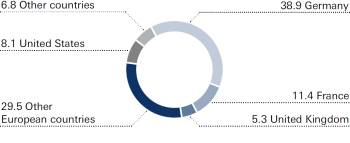

In 2018, 10 years after the new BMG opened for business, Bertelsmann’s music subsidiary continued to see significant growth in its revenues and results, especially in its core markets: the United States, the United Kingdom and Germany. After years of growth mainly through acquisition, the focus increasingly shifted to organic growth. BMG benefited in particular from the expansion of its recordings business, which grew strongly during the reporting year; the music publishing business also recorded continuing growth. BMG artists and songwriters had numerous hits in the single and album charts in 2018.

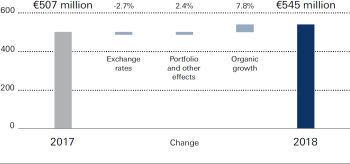

Despite negative exchange rate effects, BMG’s revenues increased by 7.5 percent to €545 million (previous year: €507 million). This was mainly due to organic growth. Operating EBITDA rose disproportionately by 17.3 percent to €122 million (previous year: €104 million), boosted by the increase in revenues and economies of scale. The EBITDA margin rose to 22.5 percent (previous year: 20.5 percent).

In the recordings business, where market growth is being driven by streaming, BMG was successful with artists including Lil Dicky, Jason Aldean, Kylie Minogue, The Prodigy and Kontra K, all with number-one albums or singles. BMG signed new contracts with artists including Dido, Marianne Faithfull, Lenny Kravitz and Adel Tawil. Keith Richards, whose publishing interests have been represented by BMG since 2013 along with Mick Jagger’s, additionally signed a worldwide contract for his solo recordings. BMG acquired the world music label World Circuit Records and the US hip-hop and rap label RBC Records.

In the music publishing business, world tours by artists including Roger Waters and The Rolling Stones contributed to higher collections, as did BMG’s administration of the Fremantle music catalog. Successful releases of works by songwriters including Jason Evigan, Bebe Rexha, George Ezra, Jess Glynne and The BossHoss added to business growth. Among the most prominent music publishing signings were Ringo Starr and JuiceWRLD. Lenny Kravitz and Yusuf a.k.a. Cat Stevens renewed their contracts with the company. BMG songwriters contributed to three of the five biggest summer hits on US radio.

BMG Production Music, which provides music specifically for movies, video games and advertising, was expanded and now has a presence in eight territories thanks to new offices in Singapore and Hong Kong.

BMG’s growing films business developed successfully with highlights including US distributor Magnolia Pictures acquiring North American rights to BMG’s first major film production, a documentary about rock singer Joan Jett (“Bad Reputation”). In the books business, the number of titles published by BMG doubled compared to 2017, and included the illustrated books “Johnny Cash at Folsom and San Quentin” and “Dreaming of Dylan.”

Arvato

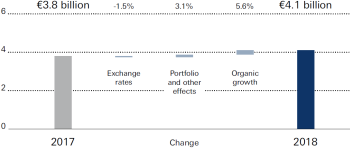

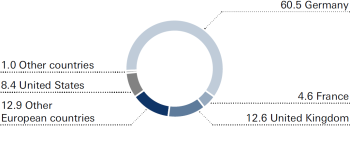

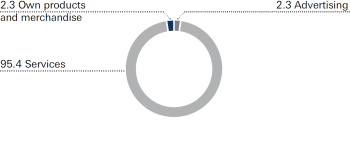

Arvato recorded a very strong business performance in 2018. Revenues from Bertelsmann’s service businesses rose by 7.2 percent to €4.1 billion (previous year: €3.8 billion), and operating EBITDA improved by 17.8 percent to €377 million (previous year: €320 million). In particular, the drivers behind this extremely positive performance were the services provided for customers in high-tech and fashion by Arvato SCM Solutions, Arvato Financial Solutions’ financial services businesses and Arvato Systems’ innovative IT solutions. Arvato’s EBITDA margin improved to 9.2 percent from 8.4 percent in the previous year.

After Bertelsmann had indicated at the end of January 2018 that it was reviewing strategic options for Arvato’s CRM business, in September 2018 it was announced that Bertelsmann and Morocco’s Saham Group were planning to merge their global CRM businesses. The new group of companies, Majorel, which took up operations on January 4, 2019, is one of the market leaders in Europe, Africa and the Middle East, and has a strong presence in America and Asia.

Arvato CRM Solutions’ service businesses delivered a satisfactory overall performance in 2018, contributing to Arvato’s revenue and earnings growth. The main growth driver was the expansion of the business with large, international clients in the high-tech and e-commerce sectors. In Germany, the contract with a large mobile service provider was renewed, and the global site network was built up and expanded.

The logistics services business within the SCM Solution Group experienced strong organic growth during the reporting period – especially as a result of new orders and clients gained in the fashion, high-tech and healthcare sectors in the previous year. In addition, important master contracts with customers were renewed. The existing worldwide network of locations was enhanced with the opening of new distribution centers and the expansion of existing ones.

The financial services businesses bundled in Arvato Financial Solutions also developed positively during the reporting period. Revenues and earnings were up year on year. This was mainly supported by a good business performance in the GSA region. 3C Deutschland GmbH was acquired in the first half of 2018 with the aim of expanding and further automating the existing range of solutions for the German automotive insurance industry.

The IT services provider Arvato Systems grew organically and profitably in the reporting period. Business with its proprietary software solutions was successfully expanded and further developed, among other things with the addition of a major client from the United States. The IT services provider also made significant progress in transforming its existing business models, and was able to win numerous customer orders, especially in the fast-growing cloud business.

Bertelsmann Printing Group

The Bertelsmann Printing Group faced a very challenging market environment in the 2018 financial year: Paper price increases in particular led to restraint on the part of many customers. Against this backdrop, the Group recorded a -2.5 percent decline in revenues to €1,639 million (previous year: €1,681 million). Operating EBITDA shrank to €85 million (previous year: €118 million). The EBITDA margin amounted to 5.2 percent (previous year: 7.0 percent).

The Bertelsmann Printing Group’s offset printing business did well in the 2018 financial year, despite a declining market. In the course of the year, Mohn Media was able to renew important customer contracts. GGP Media, the company specializing in print solutions for book publishers, posted slightly lower revenues than in the previous year due to weaker demand from several key customers. The BPG subsidiary Vogel Druck, which specializes in magazines and catalogs with small to medium-size print runs, was able to win new reference customers.

The gravure printing activities bundled in the Prinovis Group declined sharply in Germany during the reporting period, due to significantly lower volumes in mail-order and magazine publishing, and its revenues and EBITDA were significantly lower than in the previous year. The Group’s gravure printing business in the United Kingdom developed as expected, despite challenging market conditions.

Demand in the US market was likewise subdued, especially in the first half of 2018; as a result, the business activities of the Bertelsmann Printing Group’s US printing plants also declined. Contracts with two important major customers were secured long-term.

As expected, revenues in storage media replication fell against the backdrop of a declining market. Sonopress was able to gain market share with the acquisition of two major customers.

The print-related marketing services businesses assigned to the Bertelsmann Printing Group offer cross-channel communication services, in particular for the retail, e-commerce and advertising sectors. These businesses developed positively; among other things, new customers were acquired and important contracts renewed in the business segments of campaign management and the DeutschlandCard multipartner program. DeutschlandCard celebrated its 10th anniversary in the first half of 2018.

Bertelsmann Education Group

Driven by the rising demand for educational services, the Bertelsmann Education Group’s activities saw continued growth in 2018. The Group markedly increased its revenues and operating result, and all of the division’s companies continued the strategic development of their educational and service offerings.

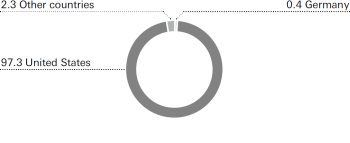

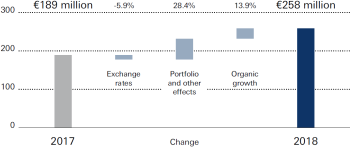

Revenues from education businesses grew significantly in the 2018 financial year, rising by 36.4 percent to €258 million (previous year: €189 million). The full consolidation of the university services provider HotChalk, the continued growth of the e-learning provider Relias and the acquisition of the US education company OnCourse Learning were major contributors to this. As a result, the Bertelsmann Education Group’s operating EBITDA improved significantly to €37 million (previous year: €3 million). The EBITDA margin was 14.5 percent (previous year: 1.8 percent).

The Bertelsmann subsidiary Relias achieved double-digit organic growth during the reporting period and expanded its client base to more than 8.400 institutions whose employees enrolled in about 37.2 million online courses in 2018. In November, Bertelsmann acquired full ownership of the US online education provider OnCourse Learning from the private equity firm CIP Capital. It integrated the firm’s healthcare training division into Relias, thereby significantly expanding the latter’s acute-care activities.

The online learning provider Udacity further developed its range of courses and introduced new Nanodegree programs in fields including artificial intelligence. It also continued expanding its B2B business; at the end of 2018, more than 50 corporate clients were using Udacity services. Bertelsmann owns a significant stake in the Silicon Valley-based company.

During the period under review, the Bertelsmann Education Group also acquired a majority stake in HotChalk, a US provider of education technology services. The company recorded a significant increase in earnings and significantly expanded its partnership with its largest customer. The number of students enrolled in courses supported by HotChalk also rose.

Alliant International University, which specializes in psychology and education, recorded an increase in the number of students in the past year and continued building its digital learning portfolio.

Bertelsmann Investments

In the 2018 financial year, Bertelsmann Investments once again expanded its global network of shareholdings in innovative start-ups. Bertelsmann Asia Investments (BAI), Bertelsmann Brazil Investments (BBI), Bertelsmann India Investments (BII) and Bertelsmann Digital Media Investments (BDMI) made approximately 60 new and follow-on investments during the reporting period. At the same time, the funds exited from several shareholdings. As a result, at year-end Bertelsmann held shares in 189 companies through its corporate funds.

Bertelsmann Investments once again made a significant positive contribution to Group profit in the year under review, primarily due to increases in the value of investments and gains on disposals. EBIT amounted to €96 million (previous year: €141 million).

BAI made 23 new investments, including in the Chinese music streaming platform NetEase Cloud Music. Follow-on investments were made in 16 companies, including the fitness app Keep and the supply chain financing service provider Linklogis. As in 2017, four BAI holdings went public in the period under review: the used-car portal Tuanche, the discount platform Meituan Dianping, the fashion e-commerce platform Mogu, and the tech company Xiaomi, in which the fund owns an indirect stake. In the 10 years of its existence, BAI has supported the IPOs of 10 shareholdings.

In Brazil, additional investments were made in the focus area of education. In April, Bertelsmann acquired a majority stake in Afferolab, one of the country’s leading providers of corporate training, through BBI and further increased this shareholding in December. The group also expanded its education network in the healthcare sector in partnership with Crescera Investimentos.

During the reporting period, BII acquired stakes in the Indian company Licious, a direct-to-consumer food platform, and in the logistics platform Lets Transport. Follow-on investments were also made in the social media portal Roposo and in Eruditus Executive Education, a continuing training company that develops courses in partnership with international Ivy League colleges. In addition, BII successfully managed its first two divestments, from Saavn and IndiaProperty.

BDMI made 17 new and follow-on investments, including in the network FloSports, which specializes in live broadcasts of sporting events.

Since 2012, the four funds have invested nearly €800 million in digital companies. Returns from the disposal of investments amounted to more than €400 million in the same period.

Combined Non-Financial Statement

The following information relates to Bertelsmann SE & Co. KGaA and the Bertelsmann Group (“Bertelsmann”) with its incorporated, fully consolidated subsidiaries (“subsidiaries”) in accordance with sections 315b and 315c of the HGB in conjunction with sections 289b to 289e of the HGB.

Bertelsmann operates in the core business fields of media, services and education in around 50 countries (cf. section “Company Profile”). Responsible conduct – in business, toward employees, in society and in dealing with the environment – is firmly anchored in Bertelsmann’s corporate culture. In its corporate responsibility management, Bertelsmann pursues the goal of reconciling commercial interests with social and environmental concerns within the Group and beyond.

For the purpose of identifying relevant topics and describing concepts, the GRI Standards 2016 specified by the Global Reporting Initiative (in particular standards 102 and 103) were used to produce the Group Non-Financial Statement. In addition, voluntary CR-reporting based on the GRI Standards (2016; Option “core”) will be published by the middle of the financial year.

Company Principles and Guidelines

The prerequisites for a corporate culture in which employees, management and shareholders work together successfully, respectfully and in a spirit of trust are common goals and shared values. These are enshrined in the corporate constitution and in the Bertelsmann Essentials. Furthermore, the Bertelsmann Code of Conduct – as a binding guideline – defines standards for law-abiding and ethically responsible conduct within the company and toward business partners and the public. The sense of purpose embodied in the triad “To Empower. To Create. To Inspire.” also provides orientation for the company’s staff and partners.

Bertelsmann’s actions are also determined by external guidelines. The company largely follows the recommendations of the German Corporate Governance Code for good and responsible corporate governance, and the OECD Guidelines for Multinational Enterprises. Bertelsmann is committed to the principles of the Universal Declaration of Human Rights, the United Nations Guiding Principles on Business and Human Rights, and the International Labor Organization core labor standards. Bertelsmann has been a signatory of the United Nations Global Compact since 2008.

Corporate Responsibility Management

Organization

The advisory body for the strategic development of corporate responsibility at Bertelsmann is the CR Council. The CR Council, which is made up of the Chief Human Resources Officer (CHRO) and representatives from the corporate divisions, focuses on the Group-wide CR objectives in line with the corporate strategy and the cross-divisional coordination of CR activities within the Group.

At the Group level, the Corporate Responsibility & Diversity Management department coordinates and supports the work of the CR Council in close cooperation with the other Group functions. Within the decentralized Bertelsmann corporate structure, the local management teams are responsible for implementing corporate responsibility through specific CR measures and projects. The corporate divisions and companies have their own structures and processes in place for this, in accordance with local requirements.

Topics

To identify key CR topics, Bertelsmann carries out regular CR relevance analyses. The current analysis was finalized in early 2018. For this analysis, the company conducted a survey of internal and external stakeholders. The external stakeholders estimated the impact of Bertelsmann’s business activity on the topics, while the internal stakeholders assessed their business relevance. This made it possible to identify topics of relevance to Bertelsmann relating to environmental, social and employee matters, and respect Bertelsmann Annual Report 2018 41 for human rights, anti-corruption and bribery matters. These topics are analyzed within the company boundaries, unless otherwise stated.

CR topics, including non-financial performance indicators, are not directly relevant to business, and are accordingly not part of Bertelsmann’s value-oriented management system. Due to currently only limited measurability, no directly quantifiable statements can be made regarding relevant interdependencies and value increases for the Group. For this reason, the non-financial performance indicators are not used for the management of the Group (cf. section “Value-Oriented Management System”).

Risks

A number of risks associated with CR topics is relevant for Bertelsmann. These risks can arise from the company’s own business activities or from its business relationships, and can affect the company or its environment and stakeholders.

For the non-financial matters defined in the German Commercial Code – social and employee matters, anti-corruption and bribery matters, respect for human rights and environmental matters – no significant risks were identifiable as part of the 2018 reporting.

For more information on the relevant risks, please see the section “Risks and Opportunities.”

Employee Matters

Motivated employees ensure long-term quality, innovation and growth. HR work at Bertelsmann is therefore based on the company’s cooperative identity as codified in the corporate constitution and the Bertelsmann Essentials. Supplementary regulations are specified in the Bertelsmann Code of Conduct and the Executive Board guidelines on HR work. The CHRO is primarily responsible for dealing with employee matters within the company. He works closely with the HR managers from the corporate divisions who report directly to him via a dotted-line concept. The focus of his work includes setting the strategic HR agenda, continual development of company partnerships, aligning management development with the Group’s strategic priorities, managing recruitment and compensation processes for key Group positions, and standardizing and providing IT support for important HR processes. In 2018, measures were taken to address the following topics.

Participation

Bertelsmann sees continual dialogue between employees and company management as a fundamental prerequisite to the company’s success. Although Bertelsmann, as a media company, is free to determine its political direction as defined in the German Works Constitutions Act (Tendenzschutz) and therefore is not subject to statutory co-determination in the Supervisory Board, company employees nevertheless nominate five members to serve on the Supervisory Board of Bertelsmann SE & Co. KGaA on a voluntary basis: four of these are works council members and one is a member of the Bertelsmann Management Representative Committee. In addition, managers, general workforce, employees with disabilities and trainees all have platforms for exchanging ideas, advancing topics and voicing their concerns. The Bertelsmann Group Dialogue Conference is an event where the CEO, CHRO and members of the Corporate Works Council can exchange ideas. Employees are also involved in the development and improvement of working conditions through standardized HR interview tools (Performance and Development Dialogue, Agreements on Objectives, Team Talk), as well as Group-wide employee surveys. In 2018 the company pressed ahead on digitization and focus of employee surveys and made preparations for the next survey in 2019.

Learning

Highly trained employees are needed to overcome major challenges such as the Group’s increasingly international focus, the digital transformation of media and services, and demographic change. By providing opportunities for lifelong learning, Bertelsmann helps to secure the long-term employability of its employees. With four different campuses – Strategy, Leadership, Function and Individual – Bertelsmann University is the central learning organization within the company. The most important measures implemented in 2018 included the further development of international programs in the areas of leadership, strategy and transformation, and formats on the topics of creativity and entrepreneurship. In addition to developing new HR programs, an international scholarship program in data science was introduced in 2018. Content of the training and courses offered by Bertelsmann in Germany was expanded to include new challenges in the workplace.

Diversity

For Bertelsmann, diversity of its workforce is a prerequisite for creativity, innovation and long-term business success. The Bertelsmann Diversity Statement adopted in 2018 also emphasized this stance. The diversity strategy is implemented by the Corporate Responsibility & Diversity Management department with support from a Group-wide working group. The focus is on “Gender,” “Generations” and “Nationality.” The Group Management Committee, which currently consists of 18 members (previous year: 17), includes 6 women (previous year: 6) and 7 nationalities (previous year: 6). To further increase diversity at the management levels, Bertelsmann has sought since 2017 to increase the percentage of women in the talent pools to one-third (Top Management Pool, Senior Management Pool, Career Development Pool). Additional topics are inclusion and sexual orientation and identity. As part of this initiative, work began in 2018 to create a Bertelsmann Inclusion Action Plan and to roll out diversity training courses.

Health

With a view to designing a health-promoting work environment and preventing work-related risks of disease, Bertelsmann is expanding a systematic health management system at German locations. Bertelsmann Health Management has been put in charge of supervising and coordinating the Germany-wide health strategy and associated activities, in conjunction with a cross-functional strategy group. The cross-divisional “Health Community,” which is comprised of health experts, works council chairs, Supervisory Board members, HR managers and representatives for employees with disabilities, plays a key role here. Through targeted networking, it also helps to reinforce uniform standards for all German locations. In 2018, another working group was created to accelerate the implementation of health management in the companies.

Fair Working Conditions

At Bertelsmann, remuneration issues are an essential part of the topic of fair working conditions. The policy is to establish consistent and transparent remuneration structures in the Group. The design of the compensation system is intended to ensure that remuneration is driven by market, function and performance, taking into account business-specific characteristics. Employee profit sharing in Germany is based on the same criteria as those used to calculate variable remuneration components for Executive Board members and executives. This includes Bertelsmann and subsidiaries based in Germany, with the exception of RTL Group and Gruner + Jahr. These and many foreign subsidiaries have similar success and profit-sharing models adapted to local requirements. In 2018, a total of €105 million of the 2017 profit was distributed as part of such schemes.

Social Matters

Corporate citizenship is one of the Bertelsmann Essentials and is thus firmly anchored in Bertelsmann’s corporate culture. As a good corporate citizen, Bertelsmann is committed to contributing to society and implemented measures in the following areas in 2018.

Creative Independence

Bertelsmann stands for editorial and journalistic independence as well as for freedom of the press and artistic license. Bertelsmann publishes a wide variety of opinions and positions. These basic principles for business activities are set forth in the Bertelsmann Code of Conduct. Bertelsmann interprets this independence in two directions: Inside the company, it means that our management does not attempt to influence the decisions of artists, editors and program managers, or to restrict their artistic or editorial freedom. In accordance with the Bertelsmann “Editor-in-chief Principle,” editorial decisions are the sole responsibility of the content managers. To the outside, this means that the company does not capitulate to political or economic influence in its coverage, and complies with existing laws regarding the separation of editorial content and commercial advertising. The result is that the company expects careful research and qualitative reporting, unaffected by fake news and online disinformation. In addition to the Bertelsmann Code of Conduct, many subsidiaries and their editors and creative departments in 2018 continued to implement their own statutes and rules to safeguard editorial and artistic independence in their day-today business and to develop these further where necessary. These statutes focus primarily on duties of care, respect for privacy, and dealing with the representation of violence and the protection of minors.

Content Responsibility

Bertelsmann reflects on the repercussions of the content it produces and distributes to protect the rights and interests of media users, customers and third parties as far as possible. Overriding principles and guidelines of media ethics are set by national and international laws governing the press, broadcasting and multimedia; by voluntary commitments to external guidelines such as the ethics codes of national press councils; and within the company by the Bertelsmann Code of Conduct and editorial statutes. In accordance with these principles and guidelines, Bertelsmann’s editorial staff are committed to, among other things, “respecting privacy and the responsible treatment of information, opinion and images.” In accordance with the “Editor-in-chief Principle,” the responsibility for media content lies solely with the content managers in the local editorial teams and creative departments.

In the area of youth media protection, content is monitored at Bertelsmann in accordance with different restrictions for each medium and region to see if it could adversely affect the development of children or young people. In this case, various restrictions come into force, such as broadcasting time restrictions or content and/or product labels. Through voluntary labeling systems Bertelsmann sometimes goes beyond the existing European and national regulations, particularly in the broadcasting industry. Other specifications relating to content responsibility are agreed through supplementary statutes at divisional, company and editorial level.

Customer Data Protection

Bertelsmann attaches great importance to protecting customer data. This includes safeguarding the personal data of individual customers, as well as information about customers that is provided to Bertelsmann by its business partners. The objective of customer data protection is to protect an individual’s right to determine who acquires what knowledge about them, and when. This also means that personal information, or information that could identify a person, must be handled in accordance with legal requirements and adequately protected against unauthorized access. In addition to the Bertelsmann Code of Conduct, customer data protection within the company is regulated by Executive Board guidelines on the topics of information security and IT risk management.

The Executive Board Guideline on Data Protection addresses the data protection framework conditions at Bertelsmann Group based on the European Union’s General Data Protection Regulation (GDPR), which went into effect on May 25, 2018, and is designed to ensure consistent data protection management across the Bertelsmann Group. A data protection management system has been in place since 2017. It addresses in particular implementation of the documentation and accountability obligations under GDPR, as well as regulations concerning governance obligations.

Responsibility for customer data protection is decentralized and rests with the management of the individual subsidiaries. To ensure compliance with local laws governing customer data protection, the subsidiaries in Germany have a data protection organization consisting of central data protection officers and local data protection coordinators. The latter report to the local management, as well as annually or on an event-driven basis to the central data protection officers, who in turn report to the Bertelsmann Executive Board. A similar organization exists in subsidiaries outside Germany. An information security management system (ISMS) based on industry-standard ISO 27001 creates the technical framework for confidential data processing. The ISMS features a regular and structured survey to ensure compliance with statutory information security requirements, a systematic recording of risks and the derivation of related mitigation measures.

Protecting Intellectual Property

Bertelsmann’s businesses develop, produce, transfer, license, and sell products and services that are protected as intellectual property. For Bertelsmann, the protection of intellectual property rights is the foundation of its business success. For this reason, the company is committed to a high level of global copyright protection worldwide and in the digital world. The Group-wide Taskforce Copyright, with representatives from the relevant corporate divisions, supports current developments in copyright and summarizes its positions in the form of joint papers.

Respect for Human Rights

Through its corporate principles and its voluntary commitment to external guidelines, Bertelsmann is committed to respecting and protecting human rights within the company and in its business relationships. For this reason, the Bertelsmann Executive Board established an Integrity & Compliance program and appointed a Corporate Compliance Committee (CCC). The CCC submits an annual Compliance Report to the Bertelsmann Executive Board and the Audit and Finance Committee. The Integrity & Compliance (I&C) department was created to manage the ongoing day-to-day work and is subordinated to the CCC in the organization. I&C supports the CCC in fulfilling its tasks and makes suggestions for necessary improvements to the I&C program. I&C ensures that employees worldwide are made aware of the key legal provisions and internal company guidelines, including those concerning the respect for human rights, and it implemented the training and communication measures necessary for this in 2018.

Respect for human rights, also within the supply chain, is expressly stipulated by the Bertelsmann Code of Conduct and the Supplier Code of Conduct. This includes the ban on child and coercive labor and the ban on discrimination and intimidation, and it reaffirms the right to freedom of association and the right to engage in collective bargaining. In addition, individual subsidiaries and Bertelsmann itself issued statements in 2018 in accordance with the “UK Modern Slavery Act” that condemn all forms of modern slavery, coercive and child labor, and exploitation and discrimination, and present measures to prevent these human rights violations. These statements are revised each year (if required). At Bertelsmann, violations of this principle may be reported by employees and by third parties via the reporting channels within the existing compliance management system.

In terms of anti-discrimination, contact persons for Germany’s “General Equal Treatment Act” (AGG) have been appointed at all German locations. Employees can contact them in the event of suspected breaches of said act. The employees are informed of their rights under the AGG and given corresponding training through a wide range of communication channels. The topic of anti-discrimination was addressed in a Group-wide e-learning program designed to build employee awareness of the issue and advise them of their rights. These activities were continually refined and expanded in 2018.

Anti-Corruption and Bribery Matters

Both the Bertelsmann Code of Conduct and the Bertelsmann Executive Board Guideline on Anti-corruption and Integrity expressly prohibit all forms of corruption and bribery. This prohibition also applies to all third parties that work for, with or on behalf of Bertelsmann, as stipulated in the Supplier Code of Conduct. Along with instructions for dealing with officials, and guidelines for the granting or accepting of gifts in the context of business relations, the Anti-corruption and Integrity Guideline prescribes appropriate due diligence processes in dealing with third parties. An appropriate due diligence review is carried out for each individual risk profile through a corresponding risk classification. This Executive Board guideline also describes the channels for reporting suspected violations and seeking advice, as well as other prevention and control measures. The Executive Board guideline for dealing with alleged compliance violations anchors an obligation to report suspected violations of the prohibition of corruption to the Bertelsmann Corporate Center. The topic of corruption prevention is globally managed and further developed by the I&C department. One of the most important measures in 2018 was advising and training executives and employees on anti-corruption and the continued Group-wide rollout of the new e-learning program on this topic conceived in 2017.

Fair Competition and Antitrust Law

Bertelsmann is committed to the principle of fair competition and condemns antitrust violations and anticompetitive behavior. The company acts against any contravention and consults internal or external experts on antitrust and competition issues. The Bertelsmann Executive Board has approved a “Group Guideline for Compliance with Antitrust Regulations.” There is an obligation to report any antitrust violations. The Corporate Legal Department offers antitrust training programs to corporate divisions and the management and employees of these divisions. A comprehensive compulsory training program for employees working in antitrust-related areas, which was also implemented in 2018, is intended to identify antitrust risks at an early stage and to prevent antitrust violations.

Environmental Matters

The Bertelsmann Environmental Policy and the Bertelsmann Paper Policy provide guidelines for Group-wide responsible use of natural resources and environmentally friendly energy and material procurement. The environmental commitment extends beyond the individual locations to the supply chain, in particular by selecting and influencing paper suppliers and energy firms. Operational responsibility for energy and environmental management, as well as for implementing measures, is decentralized and rests with the management of the individual companies. The international “be green” Working Group with representatives from the Bertelsmann corporate divisions again provided a platform for crossdivisional exchange on environmental topics in 2018. The cooperation will focus on increasing the use of paper from certified or recycled sources and reducing greenhouse gas emissions from the consumption of energy, heat and fuels. Experts from the “be green” Working Group also coordinate the annual collection of key environmental figures, which creates transparency about impacts on the environment and climate and Bertelsmann’s environmental performance, and enable the management to derive measures for improvement. In 2018, in parts of the Group, the annual environmental data collection was conducted for the first time with an IT-supported environmental platform, and preparations were made for a rollout in other divisions. The Group-wide environmental key figures are published on the Bertelsmann website.